Whete Are the Most Reasonably Continuing Care Retirement Community

Continuing Care Retirement Facility And Communities

Click here to see what's on this page.

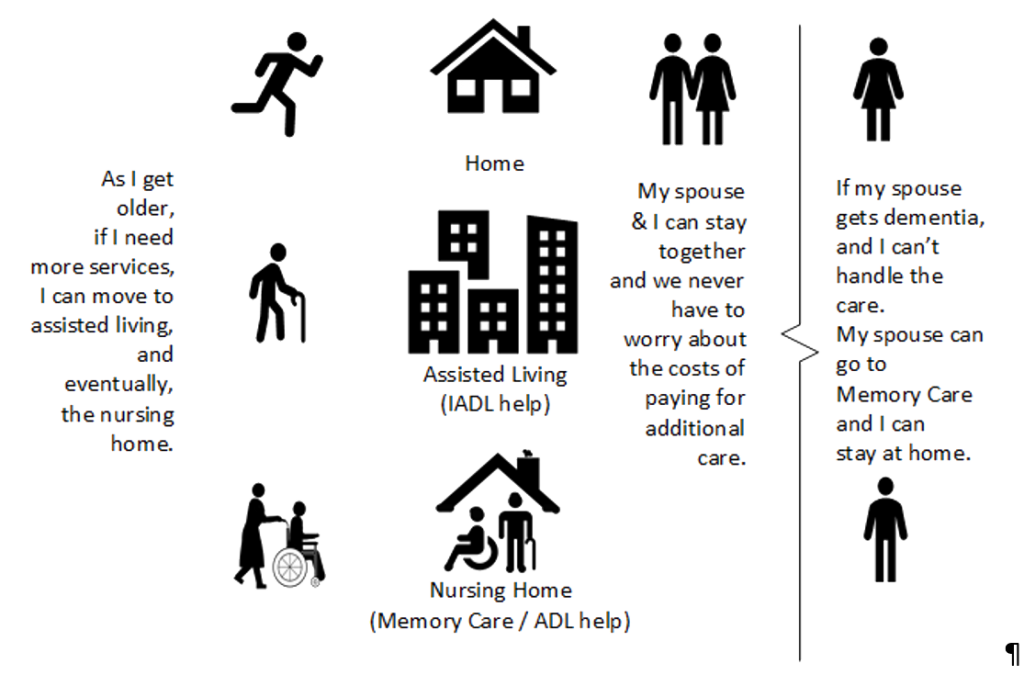

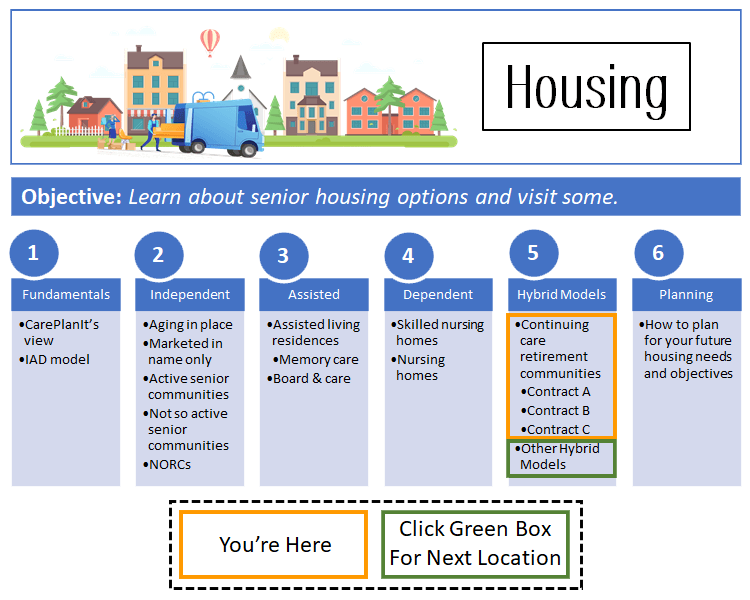

Continuing care facilities, also known as continuing care retirement communities (CCRC), provide seniors housing matching their care needs. Remember CarePlanIt's IAD housing model. There are only three ways to live; independent, assisted, or dependent. CCRC's provide each of these levels of care in some coordinated manner. Generally, the different levels of care are offered on the same campus or in the same general geographic area.

Thus, CCRCs value proposition and marketing focus is as your care needs increase, you simply move into the housing you need .

Continuing care communities offer a complete solution to senior housing. One where you can start off in an independent living environment and move, as needed, to a completely dependent environment like a nursing home.

The Benefits of Continuing Care Retirement Communities

CarePlanIt's five master techniques are housing, health, finances, end-of-life chores, and family communications. There are over 2,000 continuing care facilities in the United States. This is a growing sector of the senior housing market. In large part because of the "buy-in." In other words, a senior must come up with $750,000 – $2,000,000 (a common range) to enter or "buy-in" to the facility. For this buy-in, they get a kind of temporary leasehold to the retirement communities' housing stock. Bankers love this model because they can fund these projects and get paid back as the community sells through.

Housing

Continuing care communities offer housing at all three levels of care. Communities have different options for each level, but generally, they offer independent living in small homes, condos, or cottages. Assisted living spaces are usually in a more congregate setting like apartments. Long-term residential care and nursing care are offered in facilities that look like nursing homes or rest homes. Once you're in, you don't have to worry about whether or not you have a place to live as your care needs increase. In other words, it's all included. CarePlanUt's view on housing is here.

Health

CarePlanIt views health as the manifestation of your health conditions. Health is all about your ability to perform ADLs and IADLs. CCRCs offer services and amenities tied to this notion of health. They also hire staff to address these issues. If you're healthy, you live in independent housing. As you lose abilities, you move to assisted and then dependent housing. Because CCRC housing options are tied to your abilities, you don't ever have to worry about health issues.

Finances

In addition to worrying about health, most seniors worry about money. Specifically, about running out of money. As we age we our income is usually fixed, and we start dipping into our savings. In short, we start running out of money. There are forms of CCRCs that allow for a large "buy-in" and temporary commitment to monthly fees in return for guaranteed forever care and housing . You need to pay close attention to the particular CCRTC contract, but one form of this contract sets up a large upfront buy-in and periodic monthly payments in return for permanent housing and care. You can never be evicted. Even if you run out of money or your committed funds' don't cover the facility's costs.

Family Communication

Another area of concern is family communication. As we age, the most difficult family communication challenges center around a parent's concern of becoming a burden on their children and their children being a burden on their parents. In other words, parents fear that declining wealth and health might require their children to take care of them. Many parents believe, for example, that this creates an unnecessary, unwanted, and damaging burden on their child's current life and commitments. There are also many situations when a child's needs start to erode and compromise a parent's ability to grow old with confidence and security. It's more complicated than this, but these issues are usually at the heart of most matters.

Sometimes Grown Children Need Help

In addition, grown children don't always grow up. Many find themselves with financial and housing needs. Some ask their parents to help. Many times parents offer to help without being asked. When a senior provides money to their children, it may compromise their future security. When a child moves in with a parent, it may limit the parent's other housing options. Regardless, this late-stage commitment to a child or grandchild can compromise a senior's ability to manage their affairs in old age.

Sometimes Helping Children Take Control

Another challenge is where children intervene in their parent's life. For example, some children will not provide money to their parents without demanding accountability and control of their parent(s) life. CarePlanIt found that in most cases where parents need money, their children believe it's because their parents made bad choices. These usually involve drug and alcohol addiction, multiple marriages or affairs, supporting children with addiction problems, and simply spending beyond their means. Consequently, the child may demand accountability and control over their parent(s) in return for the money. Conversely, parents (seniors) that raised these children and provided for them in their childhood resent this control.

CCRCs Solve These Challenges

CCRCs create lifelong housing options combined with lifelong health oversight. This eliminates most of the reasons parents feel they may become a burden to their children. Also, their children don't have to worry about becoming their parent's caregivers or providing thousands of dollars to help with their parent's housing. Their parents have prepurchased housing and care services essentially. This prepurchase and commitment also eliminates a senior's ability to provide unlimited money to their children. It stops caring parents from spending money that would compromise their future.

End-Of-Life Chores

Even in areas like end-of-life-chores, CCRCs offer a variety of solutions. The solutions converge on CCRC requirements that the senior(s) create and provide most documents to manage end-of-life issues. Before admission, the CCRC will require the resident(s) to provide or have the power of attorneys, an advance medical directive, and a will or trust. They'll also want records of bank and brokerage accounts, insurance policies, and other owned assets.

How Continuing Care Retirement Communities Meet The Needs Of Seniors – Example 1

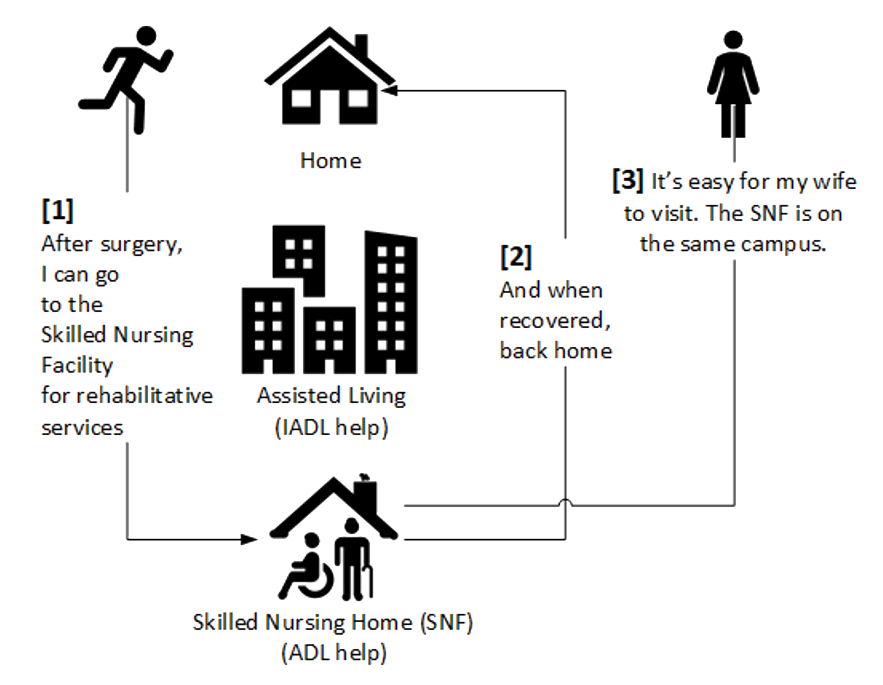

Burt and Laney were married at twenty-one and stayed lovingly married until Laney passed at eighty-six and Burt at ninety-six. Burt was remarkably healthy all his life. But at seventy-five, he developed Alzheimer's. Laney was overwhelmed trying to care for Burt, and her family was worried their mother's health was diminishing at an alarming rate. After realizing that staying in their own home would require huge expenditure on care, Burt, Laney, and their family decided the best option was a continuing care community. A one-time buy-in, ongoing fees, and a promise that care would continue regardless of Burt and Laney's financial resources.

Carmen and I learned early in our research that many married seniors fear what to do when one spouse becomes chronically ill or severely impaired and the other doesn't. This isn't easy on every level.

For example, common questions include:

- How do I, the healthy spouse, manage this situation without becoming sick myself

?

-

How do I get the finances, or resources, necessary toaccommodate my debilitated spouse?

- What house is

appropriate for thissituation ?

The couple can turn their home into an assisted living care facility or a nursing home. This costs several hundred thousand dollars a year. Or the healthy spouse can try and provide the care that an assisted living facility or nursing home might provide. This puts intense strain on the healthy spouse. If the couple chooses to stay at home and one or both of their conditions worsen, costs rise, and positive outcomes decline. If the health of one or both spouses declines, the equation of staying at home needs rebalancing.

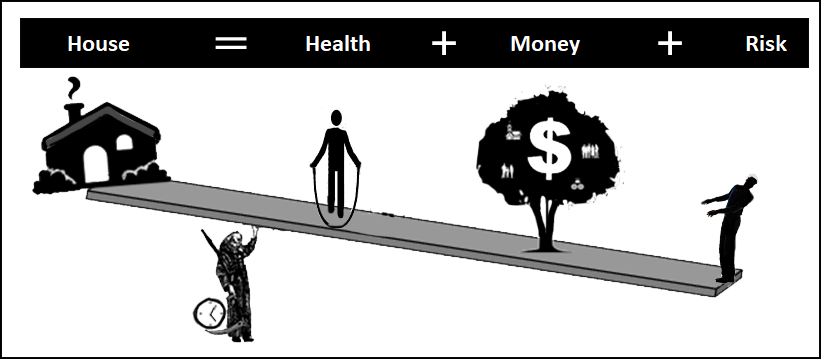

CarePlanIt's Aging At Home Or Staying Home Equation

Carmena and I have discussed in other sections the equation we discovered for staying in your own home. We're showing it to you again below.

The equation demonstrates that your ability to manage a home is tied to your health, money, and risk you're willing to accept. Because your health is declining (getting smaller), your either need to increase the money spent to replace the things you or your spouse did (your money or resource tree) or increase the risks you're willing to accept.

CCRC Models Address These Concerns

Classic continuing care communities are built, designed, and priced to address the housing equation. In fact, they're the only third-party solution that can literally change your house. You can start in a house.

As your health declines, you can move into an assisted living environment. You don't need to use your money or accept the additional risk to balance the equation. The CCRC does it as part of your contract.

If your health gets really bad, you can move into a nursing home. Normally that would cost $120,000 – $220,000 a year. Again, the CCRC contract (Type A) pays for that.

In other words, CCRC's offer a variety of levels of care. These are provided within the community. The facilities may be on the same campus or nearby. Residents usually include independent, assisted, and dependent options along with corresponding health services. Residents can move into the residence that best matches their care needs.

Spouses Can Live Separately In Many Continuing Care Facilities

In a classic CCRC, the spouses can occupy different residences. So the spouse needing the SNF or memory care can move to the nearby facility, and the healthy spouse can stay at home. The classic scary scenario is when one spouse gets Alzheimer's and the other remains healthy. In the right CCRC, both spouses can live healthy and happy lives. To learn about how Alzheimer's impacts people's lives, please see Teepa Snow. She offers expert advice on Alzheimer's and has several informative free videos.

CarePlanIt strongly advocates CCRCs for any senior couple wealthy enough to qualify for this type of option. If Alzheimer's is a risk factor for you or your spouse, find a CCRC with a great Alzheimer's unit and visit.

Of the hundreds of seniors Carmen and I interviewed, we heard many stories about couples trying to manage each other's care. Some of the challenges include:

- Long drives to SNFs or nursing homes

- Confusion on when to bring a spouse home

- Financial panic related to unknown care requirements post hospitalizations

- Financial panic regarding how long a spouse will require dementia care

- Inability to lead one own life while a spouse was confronting chronic or requires 24/7 care

- Overcommitting end of life medical interventions because of guilt associated if the spouse passed on their watch

- Spouses electing feeding tubes, ventilators, and dialysis because they believed their spouse had to live at all costs

Classic CCRC's eliminate these issues.

How To Think About The High Costs Of CCRCs

Providing comprehensive care for seniors can be costly. Moving to a CCRC should be thought of as a final housing decision. If you stay on your own, you'd have capital costs associated with your housing. You'd have monthly expenses needed to live. And you'd have investments and savings to account for unforeseen events. CCRCs will do something very similar.

Don't Let High Entrance Fees Dissuade You

The CCRC will have an entrance cost. This cost can range from $200,000 to over $1,000,000. You can think of this as the residence component of the fee. This high upfront cost is what the CCRC uses for their capital purchases (housing stock). Then there are monthly costs. The monthly costs may be between $1,000 and $5,000. These are the day-to-day living expenses. Think food, electricity, gas, and water. Finally, there are investments and savings for unexpected events. For CCRCs, these are maintenance, new buildings, etc. The CCRC creates these out of the combination of your entrance costs and monthly fee.

Most CCRC classic arrangements do not require you to increase or change your payments. In fact, if you run out of money, the CCRC doesn't care. They've accepted you and qualified you based on what you bring to the community. You're there for life.

CCRCs have developed a variety of payment options. These options are put into contracts. These contracts define what types of residences and health services will be provided and their payment requirements.

The industry generally uses three types of contracts: type A, B, and C. These contracts differ by CCRC, but what's described below will give you a general idea of what to look for and how to put the different levels of coverage in context.

Before moving on , make sure you've reviewed Contract A, Contract B, and Contract C. They are very different and have a substantial impact on short and long-term costs.

Source: https://careplanit.com/housing/types-of-senior-housing/hybrid-senior-housing-environments/continuing-care-facilities/

0 Response to "Whete Are the Most Reasonably Continuing Care Retirement Community"

Post a Comment